Whether you’re a new entrepreneur or an experienced business owner, grasping Singapore’s corporate tax landscape is vital. At only 17%, Singapore’s corporate income tax rate is among the lowest worldwide, making it an attractive destination for businesses globally.

However, there’s more than just the standard rate. With various tax exemption schemes like the Partial Tax Exemption (PTE) and the Start-Up Tax Exemption (SUTE), your effective tax rate could be significantly reduced. You could potentially pay as little as 4.25% on your first S$200,000 of taxable income!

Let’s explore some practical strategies to optimise your taxes while ensuring compliance is maintained for your company.

Singapore corporate tax rates and exemptions

Singapore boasts one of the world’s most business-friendly corporate tax rates at just 17%. It’s no surprise that many entrepreneurs are drawn to this tiny city of ours to start businesses. The real advantage, however, is that Singapore offers generous tax exemption schemes, which can reduce your effective tax rate even further.

Tax exemption schemes

First, let’s look at the Partial Tax Exemption (PTE). Under this scheme, 75% of the first S$10,000 of your company’s chargeable income is tax-exempt. Additionally, 50% of the next S$190,000 is also exempt from tax. This results in substantial tax savings!

Are you running a new start-up? The Start-Up Tax Exemption (SUTE) is designed specifically for you. With SUTE, an impressive 75% of the first S$100,000 of chargeable income is exempt from tax for the first three years, and 50% of the next S$100,000 is also exempt. It’s a great way to start your business journey with significant tax benefits.

Partial Tax Exemption (PTE)

To delve deeper into PTE: as mentioned, 75% of the first S$10,000 and 50% of the next S$190,000 of your chargeable income are exempt from tax. Practically, this means:

- For the first S$10,000 of chargeable income, you only pay S$850 in taxes (17% of 25% of S$10,000).

- For the next S$190,000, you pay S$16,150 (17% of 50% of S$190,000).

Therefore, if your total chargeable income is S$200,000, your effective tax rate would be just 8.5% ((850 + 16,150) / 200,000).

Start-Up Tax Exemption (SUTE)

Now, regarding SUTE: if your company is newly incorporated, you can benefit from a 75% exemption on the first S$100,000 and a 50% exemption on the next S$100,000 of chargeable income for your first three Years of Assessment.

For example, if your chargeable income for each of the first three years is S$100,000, with SUTE, you will only pay S$4,250 in taxes each year (17% of 25% of S$100,000), resulting in an effective tax rate of just 4.25%.

How does your company qualify for tax exemptions?

To qualify, your company must be incorporated in Singapore and be a tax resident for the relevant Year of Assessment. Additionally, it should have no more than 20 shareholders during the basis period.

These conditions are generally manageable for most small to medium enterprises. It’s crucial to be aware of these exemption schemes and take full advantage of them. With one of the most competitive corporate tax rates and exemption schemes in the world, Singapore is an excellent choice for establishing a business in a tax-friendly environment.

How to calculate taxable income for Singapore companies?

Now that we’ve discussed Singapore’s appealing corporate tax rates and exemptions, let’s delve into calculating your company’s taxable income. It’s more complex than simply referring to your profit and loss statement. You need to understand key concepts such as chargeable income, deductions, and allowances.

1) Determining Chargeable Income

Chargeable income is essentially your taxable income, calculated by subtracting allowable expenses and deductions from your total income. Total income includes revenue from sales of goods and services, rental income, interest income, and other sources. Essentially, it encompasses any money that comes into your company.

From this total income, you can deduct expenses incurred solely and exclusively in generating that income, such as staff salaries, rent, utilities, etc. Additionally, you can claim capital allowances on business assets like computers, machinery, and vehicles, which help offset the asset’s cost over its useful life.

2) Deductions and Allowances

There are numerous tax deductions and allowances available to reduce your chargeable income. Some of the most common include:

- Capital allowances on plant and machinery

- Renovation or refurbishment deductions

- Intellectual property rights allowances

- Research and development (R&D) expenses

- Approved donations

- Foreign tax credit

Keeping detailed records of all your income and expenses throughout the financial year is crucial. This will enable you to maximise your deductions and minimise your tax bill.

3) Treatment of Investment Holding and Property Development Income

Special rules apply if your company is an investment holding entity or engages in property development.

- For investment holding companies, expenses incurred in generating dividend income are generally not deductible.

- If your company earns rental income from properties, you may need to apportion your expenses between rental income and other income sources.

- Property development companies are taxed progressively based on the percentage of completion method, meaning you pay tax on your profits as you earn them rather than in a lump sum at the end of the project.

It’s crucial to understand how these rules apply to your specific situation. If you’re uncertain, it’s always wise to consult with a qualified tax professional or services like Sleek.

Calculating your company’s taxable income in Singapore requires an understanding of the rules and attention to detail. By grasping concepts like chargeable income, deductions, and allowances, you can ensure you pay the correct amount of tax while retaining more of your hard-earned profits.

Tax residency and foreign-sourced income

As a business owner in Singapore, it’s crucial to understand the concept of tax residency and its impact on your company’s tax responsibilities. Your tax residency status affects how foreign-sourced income is taxed and determines your eligibility for various tax exemptions and reliefs.

Criteria for Singapore Tax Residency

So, what qualifies a company as a Singapore tax resident? It’s not just about being incorporated in Singapore. The primary criterion is that the control and management of the company’s business must be exercised in Singapore. Practically, this means that your company’s board of directors meetings should take place in Singapore, and key management decisions should be made within the country. The company may not be considered a Singapore tax resident if control and management are exercised from outside Singapore.

Taxation of Foreign-Sourced Income

One significant advantage of being a Singapore tax resident company is the potential exemption of foreign-sourced income from tax. This can include:

- Foreign-sourced dividends

- Profits from foreign branches

- Foreign-sourced service income

To qualify for this exemption, the foreign income must:

- Have been subject to tax in the source country at a rate of at least 15%.

- Be remitted back to Singapore within a specified timeframe.

This exemption can benefit companies with international operations, allowing you to bring profits back to Singapore without additional tax liabilities.

Why does the company’s residency matter?

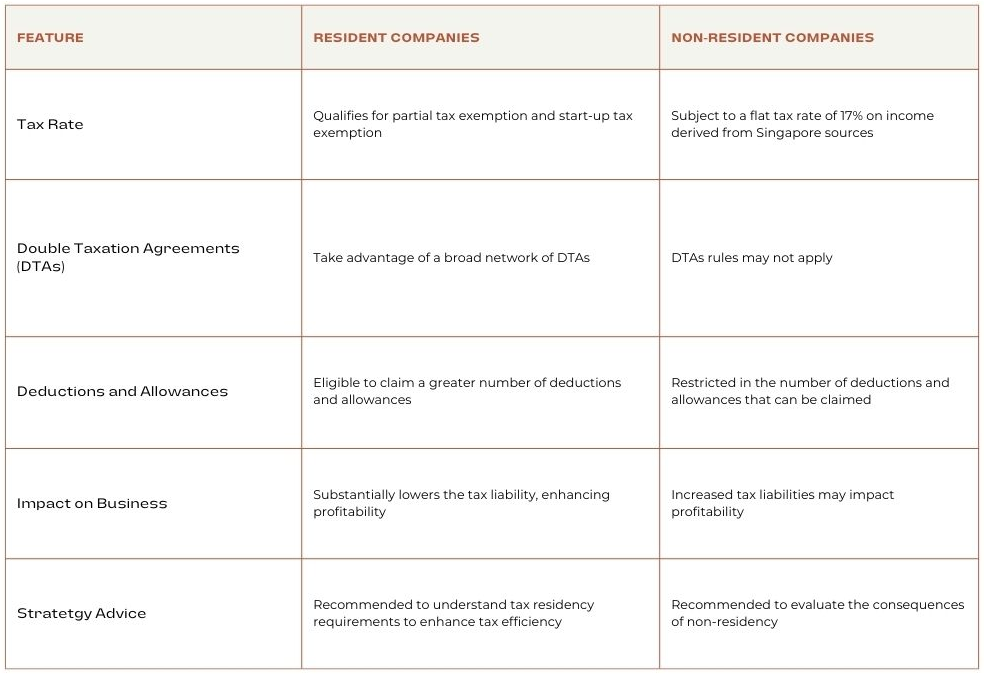

Here, we have the differences between a resident and non-resident company in terms of corporate taxes.

Comparison between resident and non-resident companies

Double Taxation Avoidance Agreements (DTAs)

Singapore further assists businesses in reducing their global tax liabilities through its extensive network of over 80 Double Taxation Avoidance Agreements (DTAs). These agreements with various countries help avoid double taxation on income and offer lower withholding tax rates.

Numerous companies that have effectively utilized these DTAs to enhance their tax strategies have demonstrated that this approach can result in substantial savings.

Claiming foreign tax credit

For companies that have already paid taxes on foreign-sourced income remitted into Singapore, rest assured that you will not face double taxation on the same income. Singapore permits the claim of foreign tax credits for taxes already paid abroad.

This relief mechanism ensures that you are not unfairly subjected to double taxation.

How should you prepare yourself during corporate tax filing season?

Filing corporate income tax returns can be complex, but with careful planning and attention to detail, it doesn’t have to be overwhelming.

Filing Requirements and Deadlines

In Singapore, companies must submit their corporate income tax returns (either Form C-S or Form C) by November 30 each year unless an extension has been granted.

Missing this deadline can result in substantial penalties and late payment interest. It’s essential to mark these dates on your calendar to avoid these issues.

Preparing Form C-S

If your company’s annual revenue is S$5 million or less, you may qualify to file the simplified Form C-S. This form requires less information than the full Form C and can be submitted electronically through the IRAS portal.

Smaller companies often find Form C-S to be a convenient option, reducing some of the stress associated with tax season.

Common Mistakes to Avoid

Despite best efforts, errors can occur when filing corporate tax returns. Common mistakes include:

- Failing to maintain proper records

- Claiming non-deductible expenses

- Omitting certain sources of income

To avoid these issues, it is advisable to implement strong tax compliance practices. This includes keeping detailed records, carefully reviewing all claims, and ensuring that all income sources are reported. Taking these steps can help prevent costly mistakes.

Managing Tax Obligations for Singapore Companies

Effectively managing tax obligations is essential for running a successful business in Singapore. Staying proactive with these responsibilities is crucial to avoiding future complications.

Estimating and Paying Corporate Income Tax

A key responsibility is estimating and paying your corporate income tax. Companies must estimate their chargeable income and pay the estimated taxes within three months after the end of their financial year using GIRO or other approved payment methods.

Avoid last-minute calculations and payments. Allow yourself ample time to ensure accuracy and prevent any late penalties.

Deductible Business Expenses

Understanding which business expenses are deductible is another critical aspect of managing tax obligations. To qualify for a deduction, expenses must be incurred wholly and exclusively in the generation of income.

Common deductible expenses include employee salaries, rent, and professional fees. Maintaining accurate records is essential to support your expense claims.

Capital Expenditure and Gains

It is also important to grasp the tax treatment of capital expenditure and gains. Generally, capital expenditures (such as costs associated with acquiring fixed assets) are not deductible. However, companies can claim capital allowances on qualifying assets over their useful lives.

Capital gains are typically not taxable in Singapore, with some exceptions.

Dividend Payments and Withholding Tax

Finally, regarding dividend payments and withholding tax, Singapore’s single-tier corporate tax system means that dividends paid by Singapore resident companies are tax-exempt for shareholders.

Additionally, there is no withholding tax on dividends paid to non-resident shareholders. This favourable treatment of dividends is one reason why Singapore remains a highly attractive business location.

Singapore’s corporate tax system is a crucial component of conducting business in the Lion City, and mastering it is essential for your financial success. With its low tax rates, generous exemption schemes such as PTE and SUTE, and an extensive network of DTAs, Singapore provides a competitive advantage for businesses of all sizes.

Understanding every aspect of corporate tax is vital for optimising your tax position and maintaining compliance. Proactive tax planning goes beyond simply reducing tax liabilities; it involves strategically positioning your business for sustained success in Singapore’s dynamic economic landscape.

If you have any questions or need further assistance with company compliance in Singapore, please do not hesitate to contact our team. You can reach the Raffles Corporate Services team via email at hello@rafflescorporateservices.com.

Yours sincerely,

The editorial team at Raffles Corporate Services