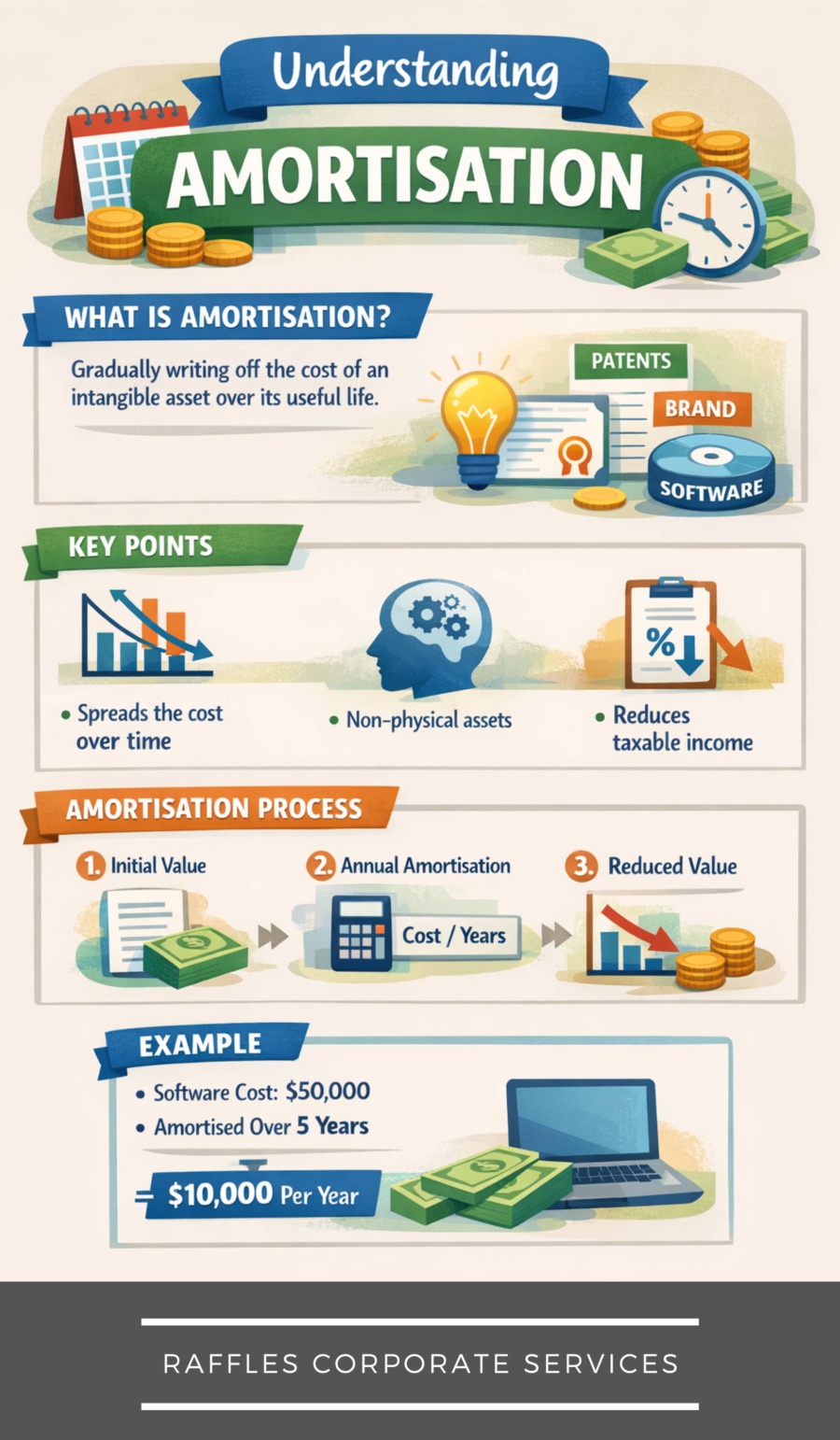

Amortisation is the systematic allocation of the cost of an intangible asset over its useful life. In Singapore accounting, it spreads the expense of non-physical assets—such as software or licences—across accounting periods. As a result, it ensures expenses are matched fairly against revenue.

When it matters

-

When a company acquires or develops intangible assets.

-

When preparing financial statements under Singapore Financial Reporting Standards (SFRS).

-

When assessing profits shown in the profit and loss statement.

-

When reviewing tax adjustments, as accounting and tax treatments may differ.

Therefore, it directly affects reported profitability.

What assets are amortised

Common intangible assets

-

Computer software

-

Intellectual property rights

-

Customer lists

-

Licences and franchises

However, goodwill is generally not amortised under SFRS and is instead tested for impairment.

Key requirements & process (Singapore)

-

Identify whether the asset qualifies as an intangible asset under SFRS.

-

Determine the asset’s useful life, which may be finite or indefinite.

-

Choose an appropriate amortisation method, usually straight-line.

-

Record amortisation expense in the profit and loss statement each period.

-

Review the useful life regularly and adjust if circumstances change.

Consequently, directors must ensure assumptions are reasonable and documented.

Amortisation vs depreciation

| Item | Amortisation | Depreciation |

|---|---|---|

| Asset type | Intangible assets | Tangible assets |

| Examples | Software, licences | Machinery, equipment |

| Accounting effect | Non-cash expense | Non-cash expense |

Meanwhile, both reduce accounting profit without affecting cash flow directly.

Worked example (SG context)

A Singapore company purchases accounting software for S$60,000 with a useful life of five years. The company amortises S$12,000 each year using the straight-line method. As a result, S$12,000 is recorded annually as an expense in the profit and loss statement.

Common pitfalls & tips

-

Amortising assets that do not qualify as intangible assets.

-

Using unrealistic useful lives to inflate profits.

-

Forgetting to start amortisation when the asset is available for use.

-

Confusing amortisation with depreciation in financial reports.

Therefore, companies should align accounting policies with SFRS guidance.

FAQs

Q1. Is amortisation mandatory for intangible assets in Singapore?

A1. Yes. Intangible assets with finite useful lives must be amortised under SFRS.

Q2. Does amortisation affect cash flow?

A2. No. It is a non-cash expense, although it reduces accounting profit.

Q3. Is amortisation tax-deductible in Singapore?

A3. It depends. IRAS allows tax deductions for certain qualifying intangible assets, subject to specific rules.

Q4. How often should amortisation be reviewed?

A4. The useful life and method should be reviewed at least annually.