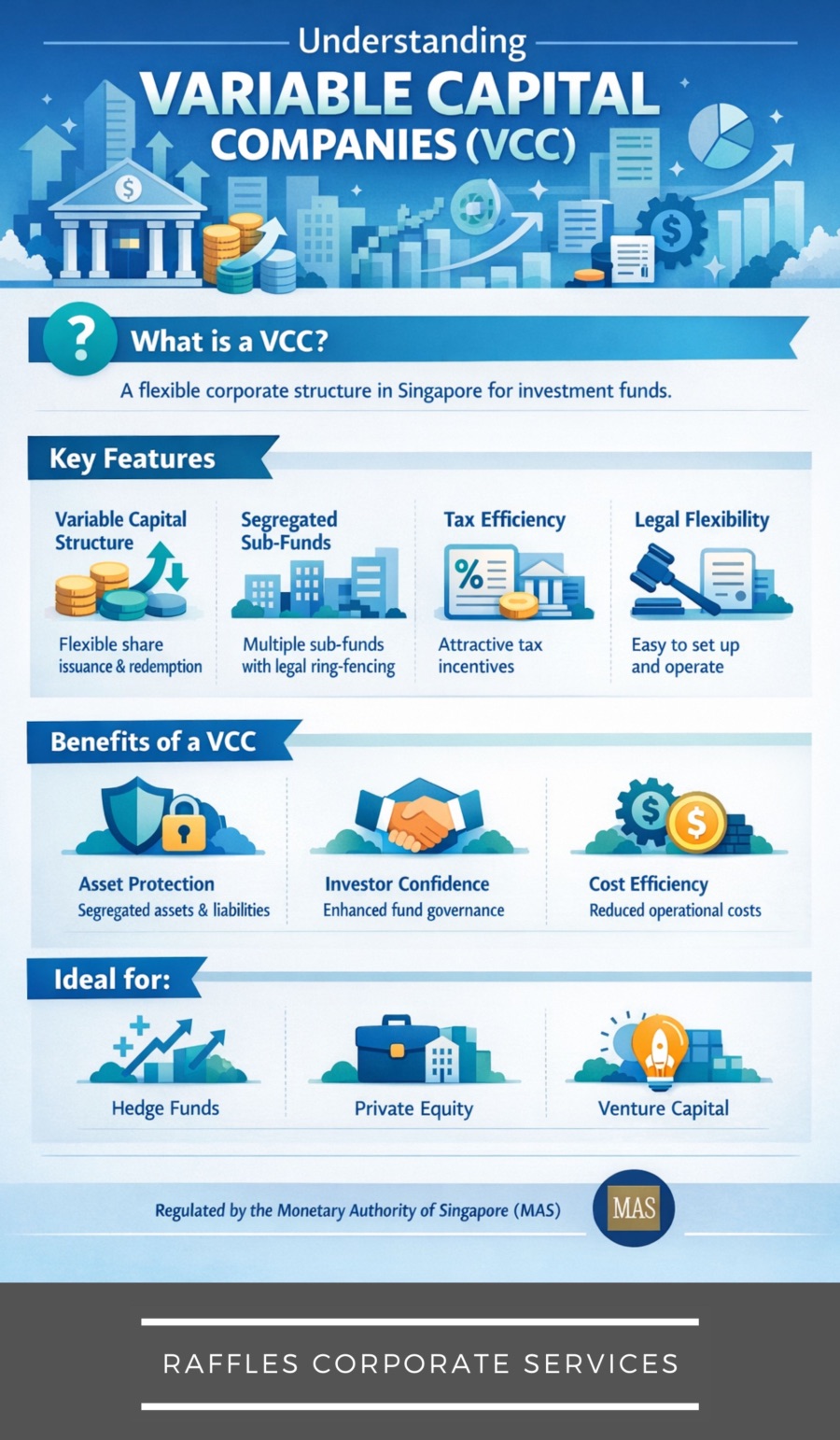

A Variable Capital Company (VCC) is a corporate structure introduced in Singapore for investment funds. It allows share capital to vary without shareholder approval and enables easy issuance and redemption of shares. As a result, the VCC is designed to meet the operational needs of fund managers while offering flexibility not available in traditional companies.

When it matters

-

When setting up investment funds in Singapore.

-

When fund managers want a flexible structure for subscriptions and redemptions.

-

When consolidating multiple sub-funds under a single legal entity.

-

When attracting international investors familiar with global fund structures.

Therefore, the VCC is particularly relevant to asset managers and private equity funds.

Key features of a VCC

Variable share capital

Unlike ordinary companies, a VCC can issue and redeem shares without prior shareholder approval. Consequently, investors can enter and exit the fund efficiently.

Umbrella and sub-fund structure

A VCC can be set up as a standalone fund or as an umbrella VCC with multiple sub-funds. Each sub-fund can have different investment strategies and investors.

Segregation of assets and liabilities

Assets and liabilities of each sub-fund are legally segregated. As a result, losses in one sub-fund do not affect others.

Confidentiality of shareholders

The register of shareholders is not publicly available on ACRA. However, it must still be maintained and made available to regulators.

Key requirements & process (Singapore)

-

Incorporate the VCC with ACRA under the Variable Capital Companies Act 2018.

-

Appoint a Singapore-regulated fund manager licensed or registered with MAS.

-

Appoint a VCC director who is either a director or qualified representative of the fund manager.

-

Appoint a Singapore-based company secretary and auditor.

-

File annual returns and financial statements with ACRA.

Meanwhile, the VCC must comply with anti-money laundering and counter-terrorism financing rules.

Tax treatment (overview)

-

A VCC is treated as a company for Singapore tax purposes.

-

It may qualify for fund tax incentive schemes, subject to meeting conditions.

-

Each sub-fund is treated as a separate taxable entity.

Therefore, tax planning should be reviewed carefully with professional advisers.

Worked example (SG context)

A licensed fund manager sets up an umbrella VCC with three sub-funds. One sub-fund invests in equities, another in private credit, and the third in real estate. As a result, investors can subscribe to specific strategies while assets and liabilities remain segregated within the same VCC structure.

Common pitfalls & tips

-

Assuming a VCC can operate without a MAS-regulated fund manager.

-

Overlooking ongoing compliance, such as audits and annual filings.

-

Confusing a VCC with a traditional private limited company.

-

Failing to document sub-fund segregation properly.

Therefore, professional structuring and compliance support are essential.

FAQs

Q1. Is a VCC only for large fund managers?

A1. No. Both large and boutique fund managers can use a VCC, subject to MAS licensing or registration requirements.

Q2. Can foreign investors invest in a Singapore VCC?

A2. Yes. VCCs are commonly used to attract international investors.

Q3. Is a VCC listed on ACRA?

A3. Yes. The VCC itself is registered with ACRA, but shareholder details are not publicly accessible.

Q4. Can a VCC have only one sub-fund?

A4. Yes. A VCC may be set up as a standalone fund or with multiple sub-funds.

Q5. Is the VCC structure permanent?

A5. Yes. However, ongoing compliance with ACRA and MAS requirements is mandatory throughout its lifecycle.